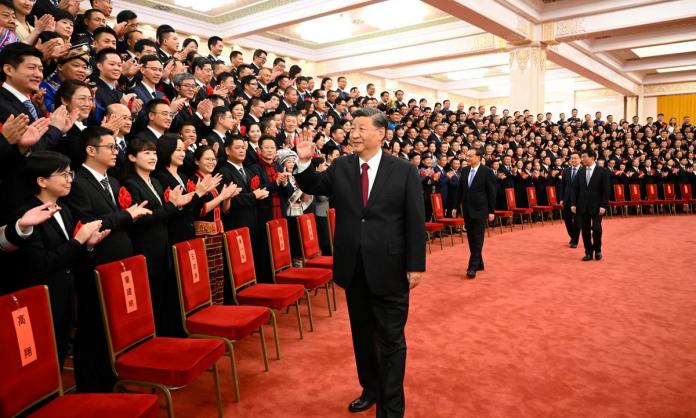

The decision by the Chinese Communist Party at its twentieth national congress to re-elect Xi Jinping as general secretary, setting him up for an unprecedented third term as Chinese president, takes place at a time of significant change in China.

In the past three decades, the country has emerged from the margins of world politics to great power status. The economy has grown dramatically, the country is the world’s biggest trading power, and it is now emerging as a significant foreign investor far from its borders. China has leveraged its growth to draw closer to itself countries in the US’s traditional spheres of influence, and its rapidly expanding military capacity confronts US dominance in the Indo-Pacific. China’s growth has also challenged what the US calls “the rules-based international order”, the network of US-dominated international institutions that oversees the global capitalist system.

The Communist Party faces no organised opposition at home and controls appointments over every civic institution, every military office and every significant state enterprise and bank. Its surveillance apparatus snuffs out criticisms that emerge on social media or in schools and universities.

Nonetheless, it does not rule by repression alone. Decades of economic growth have lifted living standards, especially for large swathes of middle-class Chinese. For anyone looking to get ahead in politics or business, membership of the party is the royal road to advancement. Far from the ambitious middle classes and capitalist entrepreneurs acting as a catalyst for liberal democracy, as Western political scientists once suggested, most have been firm supporters of the Communist regime, from which they have benefited immensely.

The party boasts of its role in ending China’s “century of humiliation” at the hands of colonial powers and lifting China’s authority in Asia and beyond—in effect, its emergence as an imperialist in its own right. “Restoration of the Chinese homeland” is the rationale the CCP offers for the absorption of Tibet, Inner Mongolia, Xinjiang, Hong Kong and, if it can manage it, Taiwan. Identification with this expansionist project, encouraged by nationalist movies and viral social media campaigns, helps solidify the party’s base among many Chinese.

Xi now reigns supreme within the party. Even under Mao Zedong, with whom Xi is often compared, the CCP was riven by internal divisions. The “Great Helmsman” was even at times sidelined by his rivals. But Xi appears to have been more successful in eliminating his opponents. Using the cover of stamping out corruption, hundreds of senior officials and hundreds of thousands of lower-ranking civil servants have been disciplined, fired or charged. Those who survive must acknowledge Xi’s greatness and “Xi Jinping Thought”, the study of which is now mandatory for all party officials.

Almighty though the CCP may appear, there are several points of tension that Xi must manage or risk his position being undermined. The economy is first and foremost. China has expanded rapidly over decades on the basis of massive investment in industry and infrastructure, which has positioned the country as the world’s manufacturing export superpower. However, these investments are yielding less and less in the way of additional growth. This weakening can be resolved if the government is willing to let the less efficient capitalists go to the wall. But doing so could wipe out huge sections of the Chinese economy, both solvent and insolvent, a risk that the ruling class is not willing to take.

This explains the government’s decision to outlay hundreds of billions of dollars to prop up Chinese industry during the 2008 global financial crisis. The injection of public funds stopped a crash but resulted in the construction of many poorly planned infrastructure projects and the survival of many big state-owned enterprises that suck in large amounts of investment but which generate losses or, at best, very low returns.

Low returns on industrial investment have encouraged Chinese and international investors to pour their money into real estate. Corporate debt exploded as property developers took out big loans from the banks and lending institutions set up by provincial governments to stimulate economic development (in the process lining the pockets of local party officials).

Property and construction became the country’s biggest industries, generating fortunes for investors. But in 2021, alarm bells rang when one of China’s biggest property developers, Evergrande, which overextended its operations, sank beneath an ocean of debt. This year, problems have become generalised across the sector as prices have started to fall. Banks are now pulling their loans and buyers of off-the-plan properties are refusing to pay outstanding balances, creating a crisis for the property developers.

Insolvency in real estate is having knock-on effects in the steel and building materials industries and causing pain to local and international investors. The credit advanced to real estate, which stimulated construction and the broader economy for a decade, has now become a dead weight. The government is faced with a dilemma: bail out the banks, even if this encourages a recurrence of speculative behaviour, or let the banks and property developers wear the pain and risk multiple business failures, including of solvent businesses starved of loans. In practice, the government flips from one to the other.

The Chinese economy is therefore bedevilled by zombie firms, speculative booms and busts in real estate and expensive government interventions to prop up businesses that do nothing to resolve the underlying economic weaknesses.

Coming on top of the property bust, China is now threatened by a worsening international trade environment as recession threatens to set in across its major export markets in Europe, the US and Latin America. Exports, along with investment, have long been one of China’s biggest engines of growth. With trade at risk, another growth driver is jeopardised.

China is also suffering economic damage from the pandemic. The government’s decision to rely on China’s own inferior vaccines (nearly three years in, China still does not administer mRNA vaccines) and its failure to prioritise elderly people most vulnerable to severe illness or death mean that the population is still highly susceptible to COVID-19, requiring repeated weeks-long lockdowns, including of the country’s main growth centre, Shanghai, earlier this year.

China’s ageing population, the slowing of mass migration of rural labour to the cities and the effects of persistent drought and other environmental problems that blight the nation are further hurting economic growth.

The result of these developments is that the era of China’s rapid growth seems to be over, the economy forecast to grow this year by just 3 percent and 4-5 percent next year, well down on the average of 9 percent since the 1990s. This puts at risk the regime’s project of lifting China into the company of middle-income countries.

The second set of problems facing Chinese leaders concerns imperialist competition. China took advantage of the US’s focus on the Middle East for many years, allowing it to expand its footprint in the Indo-Pacific. Imperialist rivalry worked to its benefit, both in fostering national unity at home and extending Chinese power. But Chinese capital must keep expanding. In particular, China must remove the US threat to its trade routes, on which its whole economy depends.

The US, however, is pushing back more forcefully. It is restricting China’s access to American technology and know-how and preventing Chinese companies such as Huawei from tendering for Western contracts, arguing that they represent a national security risk. China is investing hundreds of billions of dollars into biotechnology and semiconductor development, but still lags in key sectors.

The US has also demonstrated to the world the enduring power of its alliances following Russia’s invasion of Ukraine. With one eye to a possible future Chinese invasion of Taiwan, the US has imposed tough sanctions on Russian exports and frozen Russia’s access to SWIFT, the international payments system through which much trade is conducted. The Chinese government, well aware of the damage it would suffer if the US led a similar program of economic isolation against it, and conscious also of its own very limited alliances, will be alarmed by the US’s success in rallying an international coalition in pursuit of its imperialist objectives.

Finally, the regime also faces the threat from the Chinese working class, the biggest in world history. Thirty years of combined repression and economic boom have made people deeply depoliticised and atomised, but the working class, although not a visible oppositional political force in China today, faces a collective enemy in China’s ruling class, which thrives off its exploitation.

Time and again workers have struck or protested for their rights at work. Time and again they have mobilised against environmentally destructive industries, government decisions that harm their livelihoods and land theft by corrupt local officials. The authorities often tolerate collective action of this nature if it remains limited, but the slightest hint that workers are anti-government or forming independent trade unions brings down the police and plain-clothes thugs against them. The threat of such retaliation, or even simply the belief that their troubles are purely local affairs, tends to limit the development of political consciousness among those who take part, as does the intervention of the state-run trade unions, which do their best to disrupt effective action.

There are reasons for hope, however. Social media platforms such as WeChat and QQ are being used to connect workers across the country, overcoming the limits of worker action in dispersed industries such as food delivery. University-educated workers are registering their opposition to dead-end jobs, in which long working hours and low pay are standard, by forming social media networks to create bonds of solidarity. Out-of-pocket home buyers have recently besieged banks demanding their money back after their developers went broke.

The regime may have prevented a frontal political challenge, but inequality and corruption continue to eat away at the CCP’s credibility. Despite regular promises by Xi to address these problems, and show trials targeting particularly notorious villains, these ills are inherent in capitalist rule. Xi and all those in the upper reaches of the party are the direct beneficiaries of such corruption or at the very least of the system that breeds it.

None of this means that Communist rule in China is under immediate threat. The situation is nothing like that facing the Communist bloc in Russia and Eastern Europe in the late 1980s. Far from being a failed economy with a population thoroughly alienated from its rulers, China has become an economic superpower, and the CCP has deep reservoirs of support.

China, nonetheless, is still subject to great tensions that are inherent in the world capitalist system. It is commonplace to analyse the Chinese Communist system as an entirely different beast to the West. But that is a fundamental misunderstanding. Its economy increasingly moves in sync with the rest of the world. Its foreign and military policies are designed to advance China’s position in a world system of competing imperialist powers. Its environmental problems mirror those of many other countries and result from the same logic of putting profit before planet. And its working class is subject to the same injuries as experienced by their brothers and sisters elsewhere.

China can no more escape the contradictions of the world capitalist order than any other country. No matter how secure the Communist regime may appear, it too is built on rocky foundations that may one day bring it crashing down.