Tony Abbott and Joe Hockey’s 2014 budget cast a long shadow. And the Liberals are trying to sneak out from under it.

Still reflecting the hesitation born of 2014’s failures, 2016 is another retreat from the 2014 rhetoric of “ending the age of entitlement”; the message now is “jobs and growth”.

There is no long term budget “structural change” (i.e. no big and ongoing reductions in social spending) that the capitalists called for in Tony Shepherd’s now forgotten Commission of Audit. However, big business is getting its key want. The government has outlined a path for the company tax burden to be reduced by one-sixth over 10 years, from 30 percent to 25 percent. It has the full backing of the major employer associations, which, after the last two years of paralysis, had low expectations and were waiting for a reset with the expected 2 July election.

The slight shift from a long term slash and burn (of welfare, pensions and public health) to handouts to the rich and small capitalists, begun in last year’s budget, continues this year: personal tax cuts for the richest 25 percent of income earners, no changes to negative gearing and the capital gains tax discount – the benefits of which overwhelmingly go to the top 10 percent of the population – a continuation and expansion of the $20,000 instant asset write-off for small and medium sized enterprises (SMEs), an immediate company tax cut to 27.5 percent for firms with a turnover of less than $10 million.

In part this is a political exercise. SMEs make up more than 99 percent of all businesses. Their owners are key to the conservatives’ fortunes. This is about shoring up the Liberal Party base and also making a play for the mostly unorganised workers employed by them.

In part it is ideological, reinforcing the narrative that social wealth is produced by bosses – the entrepreneurs who run companies – rather than the workers who perform the labour and are paid a wage worth less than the value they create over the course of a week. The more that this fiction is accepted, the easier will be the task of selling policies that benefit business and eroding those that benefit the working class collectively.

There is economic logic as well. According to research conducted for the Office of the Chief Economist in the Department of Industry, SMEs younger than five years old employ only 15 percent of the workforce, but account for 40 percent of net new jobs. Most are in start-up companies (those less than two years old), but the share of start-ups among all firms has declined over the last decade. This is one area of the economy Turnbull knows he might actually boost and get the furious backing of the opposition and the Senate to do so.

For the government, this is an exercise in biding time and hoping that Liberal fortunes, in the form of “rebuilding trust”, can be lifted in order to launch renewed attacks should it be re-elected. Indeed, decreasing corporate taxes should be seen as a pre-emptive move to increase pressure in the future (economic pressure, pressure from the corporate world, and pressure from the media) to “diversify the tax base” – i.e. increase the GST, which will place more of the tax burden on the income poor.

Nothing for workers

For all the talk about how this will be great for employees, this is, yet again, an anti-worker budget.

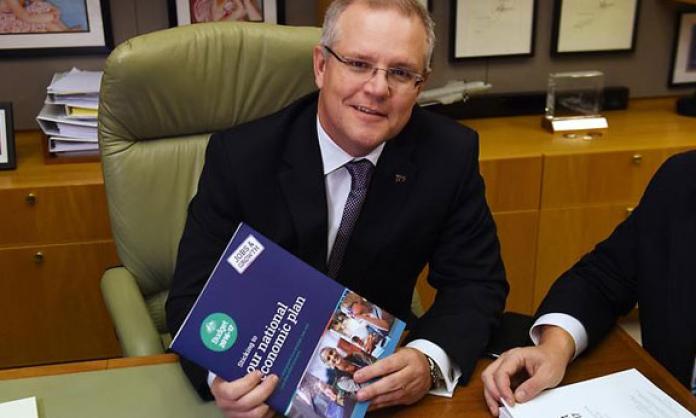

Only the Liberals – who want to get rid of penalty rates and smash the trade unions that defend working conditions – can with a straight face say, as treasurer Scott Morrison did in his budget address, that more money for bosses is a boon for workers: “By 2020 more than half of all employees of companies in Australia will be in companies paying a lower tax rate of 27.5 per cent. That's around 4.9 million employees, whose jobs will be supported …”

Private debt is continuing to soar as wage growth stalls. Yet there is nothing here to rein in the big banks, which are making a killing out of working class people who have taken out massive mortgages to get a roof over their heads. There is $89 billion set aside to build ships and submarines, supposedly for “defence”. But more security would be provided if it were channelled into public housing and helped bring down the property bubble which is the cause of so much financial anxiety. Instead, there is $115 million cut from homelessness services.

The Liberals are taking $200 million per year from the public dental scheme, tightening the welfare safety net, refusing to properly fund public education and increasing the tobacco tax (which disproportionately hits poorer people). They have made no indication that they want to retreat indefinitely from earlier unpassed attacks such as cuts to the Family Tax Benefit, cuts to the Pharmaceutical Benefits Scheme and access restrictions to the government’s paid maternity leave program. And the $240 million cuts to emergency relief and financial support to women and children leaving violence are still there.

The government is trying to suggest that a moderate tightening of superannuation tax concessions, which will cut back a small amount of the rorts for the rich, are in the interest of “fairness”. It is a tiny shift to provide a narrative to win the election. Concessions to the rich remain to the value of tens of billions of dollars per year.

Superannuation was always about creating a multi-tier retirement system that benefits those with the highest incomes, undermines the universal pension and makes people’s retirement income dependent on the market. The attempts to increase the eligibility age and reduce payments for the pension over coming decades will continue. And this budget cuts $1.2 billion from aged care.

Fail

The pattern over recent budgets has been for over-optimistic revenue growth forecasts in the face of collapsing commodity prices. Labor’s 2010 budget overestimated total government revenue collection over the next four years by $124 billion. The Liberal’s first budget in 2014 made a two-year error of $30 billion.

Over the last year, GDP growth has accelerated, non-mining corporate profits have risen, labour force participation has increased and unemployment has declined. Net household wealth has grown due to the surging residential property prices, giving a backstop to consumption, and residential construction has continued at pace. There also has been a recent partial recovery in the iron ore price.

But none of that has been enough to buck the trend. Since the 2015 December mid-year update, revenue projections for 2016-17 have been downgraded another $4 billion, and over the coming three years by $11 billion.

This comes at a time of historically high population growth in which public infrastructure spending has collapsed to its lowest point in more than a decade. Governments should be increasing, not reducing, their revenue base from the super wealthy and big business. They should be ending capital gains tax discounts, and handouts to mining companies, big polluting power companies, elite private schools and the like.

The refusal to do so, covered under shifty language about “fairness”, “responsibility” and “jobs”, belies the real agenda of the Liberal government: an economy that generates ever greater riches for an already wealthy minority and which puts the needs of working people well down the list.